Results of the 3rd annual Insect Industry Survey, part 2 of 3

Earlier this year we launched the 3rd annual Insect Industry Survey – again with a great number of responses, Thank You for that! This is the 2nd part of the results, part 3 will follow soon enough. This part here will focus on sales and marketing of insect products and services. If you missed the first part of the results, you can find it here.

The Sales and purchasing

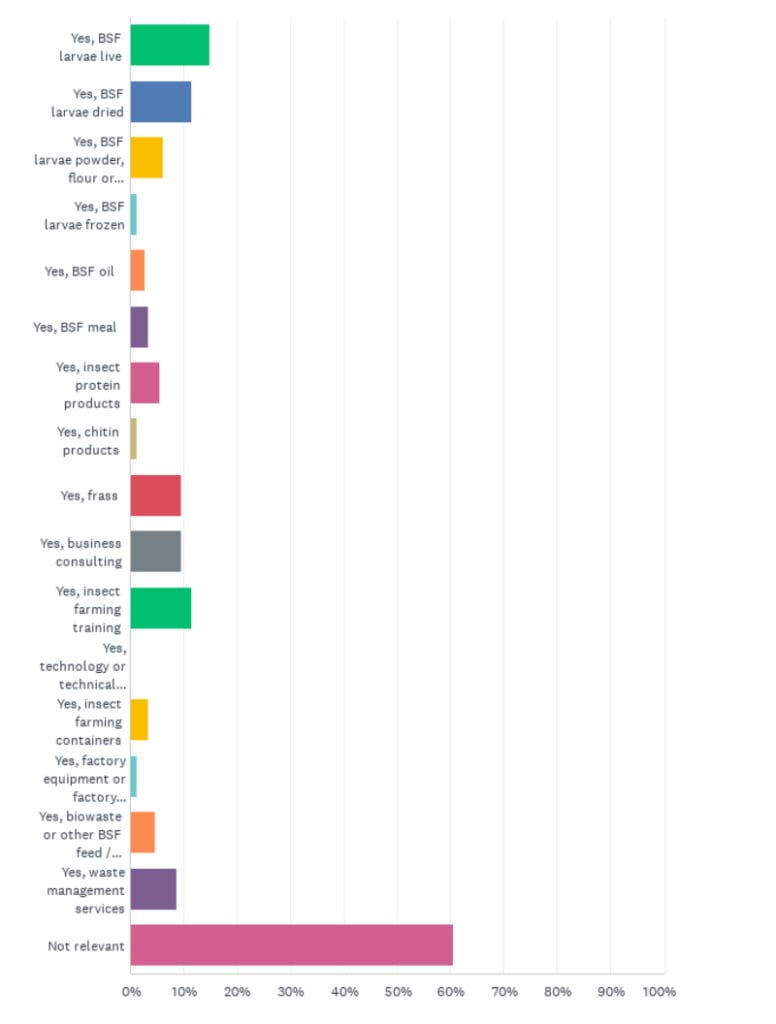

Let’s start with sales right on, with the question: “Are you selling products, tools, technology or services related to black soldier fly farming?”

Quite a few of our respondents came from research and educational field, and many also were not quite there yet with their production plans, that talking about sales would have been a relevant topic, thus “not relevant” was clearly the most common response to this question and not all respondents answered this question at all. That aside, let’s look at the actual product scale.

Roughly 15% are selling live BSF larvae, 11.5% sell BSF larvae dried, another 11.5% sell insect farming training, 9.5% sell insect frass and another 9.5% sell business consulting.

Digging deeper, almost 9% sell waste management services, 6% sell BSF larvae flour or powder or crushed larvae, c. 5.5% sell insect protein products and 4.8% sell biowaste or other types of BSF substrate. All other options fall below 4% share of responses, meaning that only 5 or less respondents sell each of these “more rare” insect products or services.

“Are you selling products, tools, technology or services related to black soldier fly farming?”

From the buy-side of things, here’s what insect farming related products, tools or services our respondents most often buy or plan to purchase;

“Are you buying products, tools, technology or services related to black soldier fly farming?”

Most commonly the respondents of the Insect Industry Survey buy BSF larvae live (c. 14% or respondents). The second most common answer was somewhat surprisingly “biowaste or other BSF feed / substrate” (9.3%), followed by insect farming training (8%), waste management services and insect farming containers (!!), both with 10 respondents, representing c. 6.6% of respondents who were in a position to respond to this question.

The most unique cases were chitin (2 respondents), BSF larvae frozen (3), BSF oil (4), and 5 respondents buying BSF production technology such as Manna MIND climatization technology, led lights, etc. technology, and also 5 people buying BSF flour / powder / crushed.

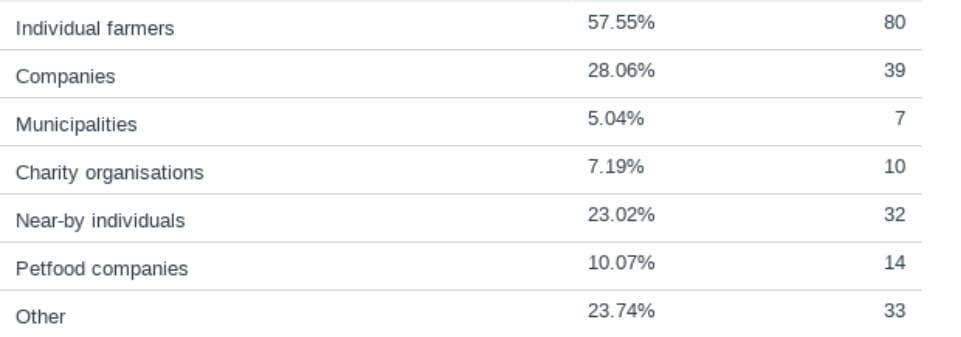

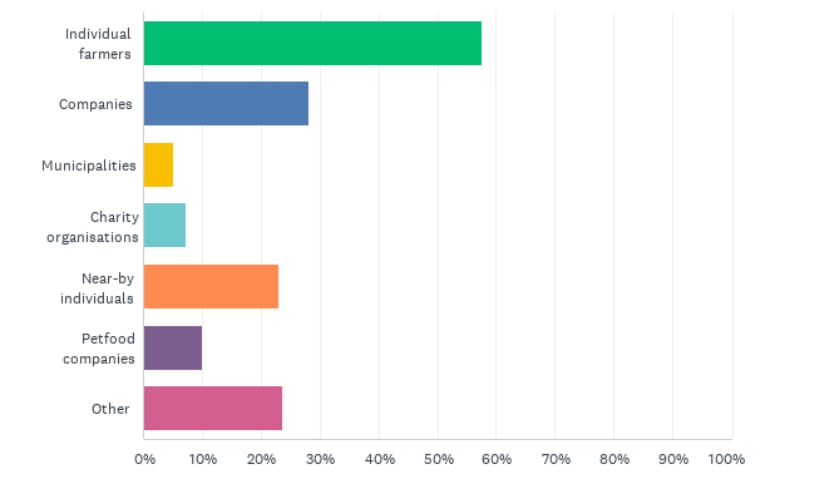

Who do you sell to or buy from?

Seems like most of the business takes place between individual producers and direct end customers. 57.55% of all respondents are dealing with individuals, while 28% deal with (bigger) companies. Also “near-by individuals” should be included in P2P sales, as over 23% of respondents describe them being the most common business partner. Approx. 10% deal with pet food companies, while dealing with municipalities and charity organizations (and other NGOs) is a much more rare case.

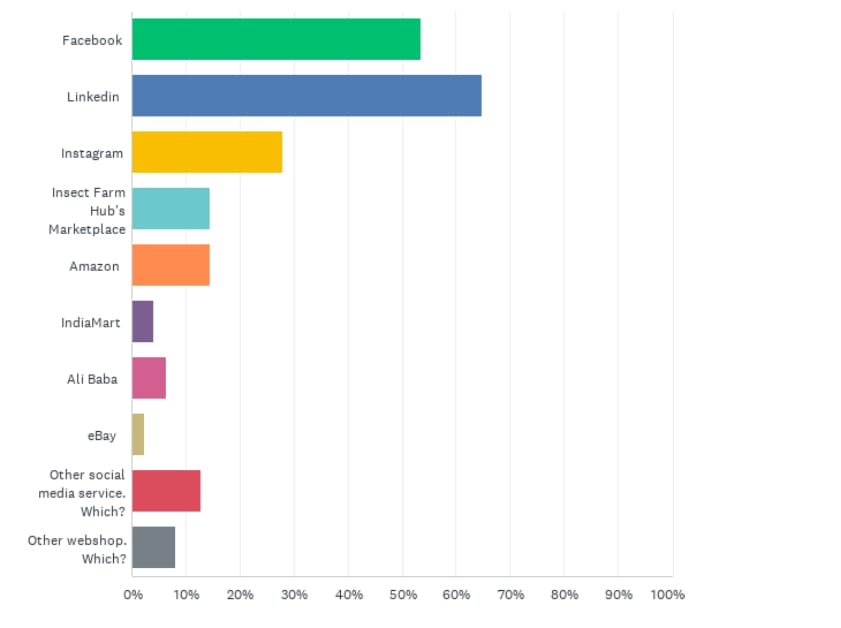

The sales channels are likely one of the most important aspects of this study. When we asked where all this business takes place, here’s what people responded;

The most important sales channels for insect farming products and services

1) Linkedin – likely services, factories, farming technology, and training

2) Facebook – Groups most likely

3) Instagram

4) Insect Farm Hub’s Marketplace (NOTE! Soon also launching as a stand-alone app) and Amazon (shared 4th place)

5) Other social media channels

6) AliBaba

7) IndiaMart

8) eBay

Now, the insect farming industry is just evolving, it’s far from ready, especially when compared to other fields of agriculture / animal agriculture, or how there are still not many or in some regions none established players for e.g. wholesale, logistic channels, subcontracting or contract farming, or widespread sales and distribution channels. This said, the first actual insect farming related marketplace is already gaining nice traction, the Insect Farm Hub’s Marketplace, but that is only the first mover, and most of the business still takes pace locally face to face and people 2 people, without more sales effort than perhaps word of mouth and a post to some (local) forum about the product availability. There’s still so much to do…

There is great potential in this industry for new players across the field, as according to our respondents, almost 65% were looking for new sales channels, and almost 26% were looking for buying opportunities, and only 4 (!!!) respondents were happy with the current set up for sales and purchasing and were not interested in finding or setting up new ones!

But that’s all for now, let’s talk more the next time around. The 3rd part of the results of the Insect Industry Survey 2025 will focus on pricing, information sharing, influencers and more, so stay tuned. In the meantime, please check out our other blog posts, follow us at Linkedin, Facebook, Instagram and YouTube, and join the free Insect Farm Hub and the Marketplace at https://insectfarmhub.com

Learn more about BSF farming in the

Insect Farm Hub!

Manna Insect has launched a comprehensive insect farming platform designed for learning, managing, monitoring and networking. There are tons of free content about insect farming, as well as a lot of paid premium content, that dives even deeper in black soldier fly business.

Read also:

Results of the Insect Industry Survey 2025 part 1

Results of the Insect Industry Survey 2024 part 1

Results of the Insect Industry Survey 2024 part 2

Results of the Insect Industry Survey 2024 part 3