Results of the 3rd annual Insect Industry Survey, part 1 of 3

Earlier this year we launched the 3rd annual insect industry survey – again with a great amount of responses, Thank You for that – and now’s the time to finally dig deep into the results that are long overdue!

I will go through the results one by one in 3 different articles, all published both here at the Manna Insect website blog section and as well as at Linkedin . This is the 1st part, which will cover lots of demographic information about the respondents, and from that we can try to better understand where the insect production really takes place, what is the state of the industry, and what really is happening and being planned.

The demographics

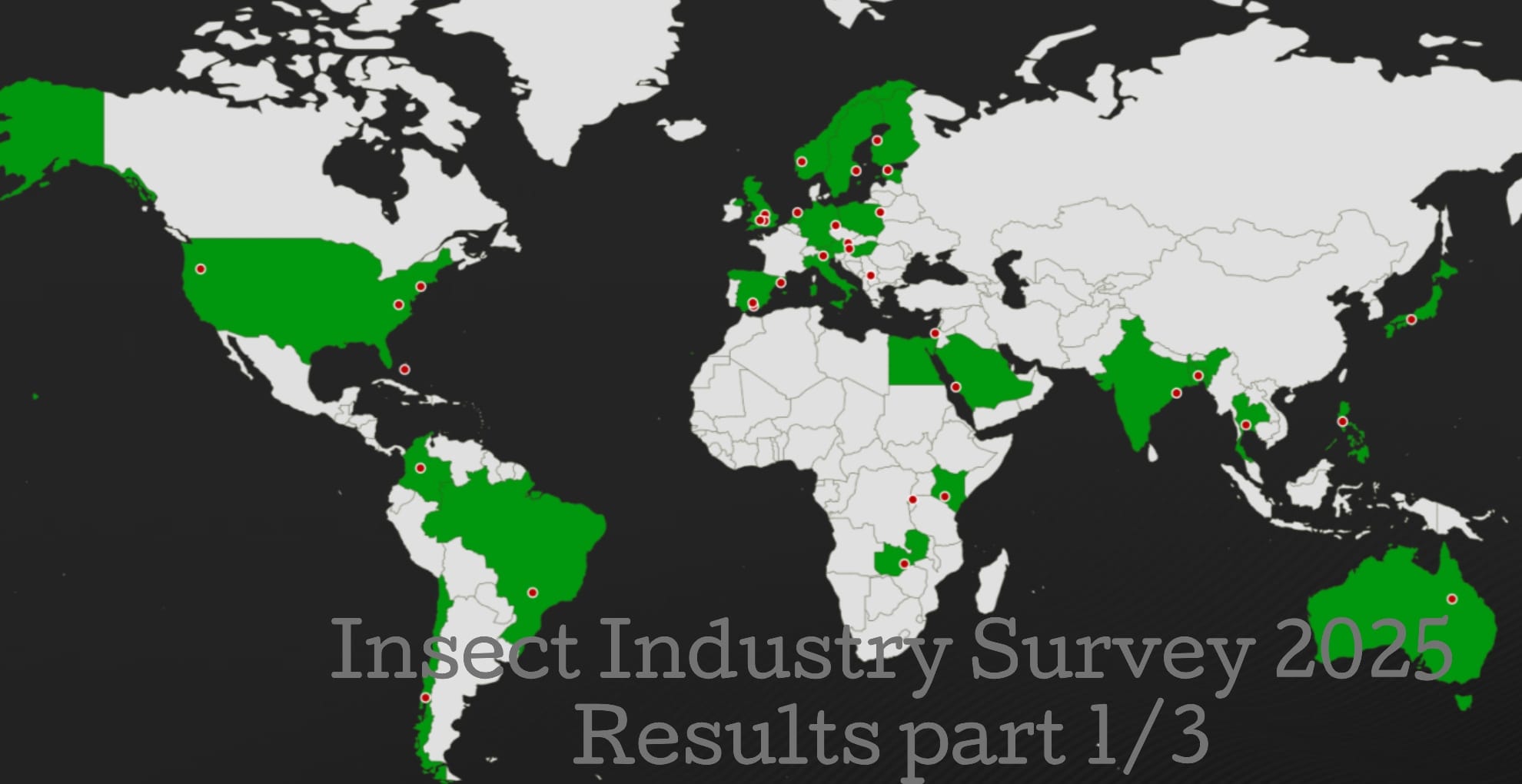

Let’s start with geography.

The top 10 countries where the survey respondents came from:

Pakistan 16,7% of all respondents

India 13,7%

Papua New Guinea 9,5%

Kenya 7,7%

Nigeria 7,7%

Nepal

Uganda

Bangladesh

Ethiopia

South Africa

Overall, we got responses from 168 individuals from 43 countries to this question. There were more respondents overall to the survey, but not all wished to leave their location data with us.

As you can see from the list of top 10 countries, the focus is clearly on the regions where BSF lives naturally – Africa and South/SE Asia.

The employers and job titles

The respondents come from all walks of life, the list of current employers is long and varied, but interesting trends can be seen. The most common employers of the respondents are typically universities, government offices such as Ministries, and various NGOs and institutes.

13% of all respondents came from NGOs and governmental offices

20,8% came from universities, schools and research institutes

Luckily this time around we also got responses from some of the bigger commercial players of the industry, such as Better Origin, Andritz, Tata and others.

Many respondents were either self-employed or students. And just like last year, we got responses from retired people as well, this time around 2 of them!

The most common job titles were either related to working at a university as a student, researcher, teacher, lecturer or professor. The amount of teachers and professors was significantly high – which is of course great, we need more education in this field!

The C-level executives were not as widely present as in previous years, perhaps the startup and growth venture financing troubles are affecting this just as well.

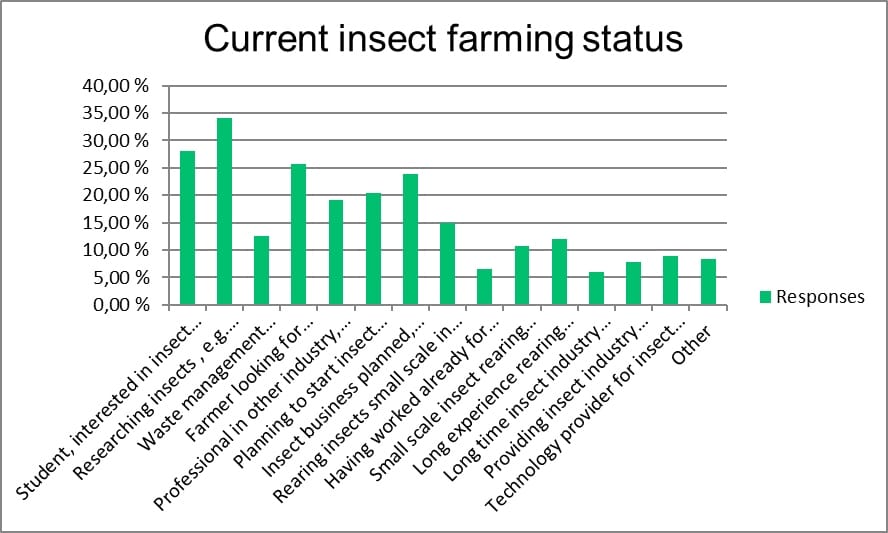

The current insect farming status, size of operation and plans

The current status of our respondents relates closely to their current employers and job titles in the educational field. Most commonly the respondents were students, teachers or researchers interested in or training insect farming.

Also, the more traditional farmers looking into insect farming were present in masses, and quite a few stated plans of starting insect farming in the next 6 months or when they get funding. Great! Let us know if we can help you in any way!

Small scale farmers planning to scale up were present in satisfying numbers, and of course quite a few offering services or products to the insect farming industry.

Which size insect industry operation are you operating currently?

Backyard shed or cages outdoors 20,86 %

Semi-professional facility with multiple rearing or breeding cages 13,50 %

Breeding container 12,88 %

Rearing & growing container 11,04 %

Factory-sized operation 4,91 %

Not farming insects at the moment 58,90 %

The question relating to the size of operation is always interesting, and as in previous surveys, many are just planning, researching and testing assumptions with insect farming, while a much smaller number of respondents are already in commercial production.

Out of those who are already farming, the focus is on small-/micro-scale, with hopes to expand the operation once the production and business cases are tested and approved to be profitable.

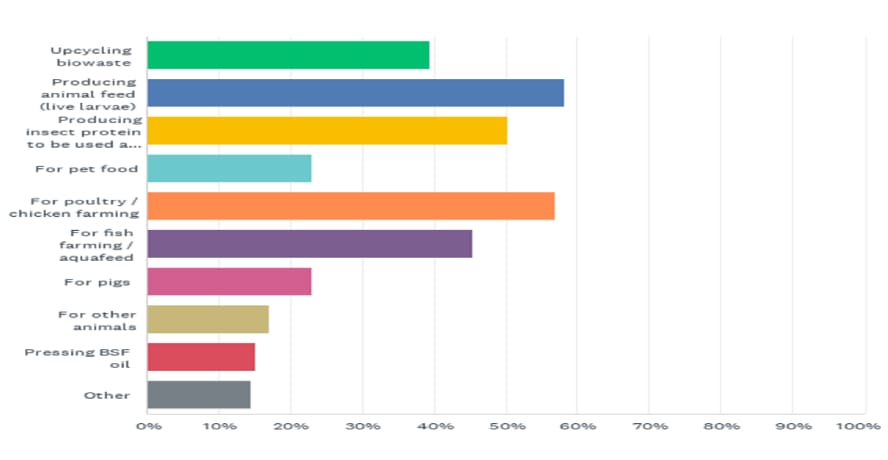

Finally, the last results for this 1st part of the series – “what do you use / plan to use insects for?”.

What do you use / plan to use insects for?

Most commonly our respondents farm or plan to farm insects for animal feed one way or the other. Almost 57% are feeding chicken / poultry with insects or insect protein in some form, over 58% are feeding farm animals live larvae, over 50% use insect protein as part of a farm animal diet, and over 23% were feeding pigs with insects – which is a growing opportunity compared to earlier surveys. The numbers are of course not resulting to 100%, as the respondents could choose multiple options, but the general approach here seems to be using insects to feed farm animals.

Also fish farmers or those working with fish feed / aquafeed were well represented, as over 45% chose the option of using insects for aquafeed. If the respondents approach insect farming from the business case point of view rather than farming insects for their own use to save in feed costs or getting rid of their own waste in a meaningful way.

Over 23% work with or plan to work with petfood production, using insect protein as a petfood ingredient or perhaps using BSF and other insects live for lizards, spiders, exotic birds and other specialty pets.

Somewhat strangely, over 15% of the respondents consider BSF oil to be an interesting business opportunity, even if the BSF oil business case may not be there yet in most regions – still, an opportunity worth considering.

Upcycling biowaste for money is a great opportunity in many countries and regions, and over 39% of our respondents considered it being an income opportunity, which is of course great! What better than getting paid to accept someone else’s waste and then use it to create sellable products, such as animal feed and frass for fertilizer. A win-win for you!

That’s all for now. The 2nd part of the results focus more on buying and selling the insects and insect products, and it will be published soon enough, so stay tuned. In the meantime, please check out our other blog posts, follow us at Linkedin, Facebook, Instagram and YouTube, and join the free Insect Farm Hub and the Marketplace at https://insectfarmhub.com

Learn more about BSF farming in the

Insect Farm Hub!

Manna Insect has launched a comprehensive insect farming platform designed for learning, managing, monitoring and networking. There are tons of free content about insect farming, as well as a lot of paid premium content, that dives even deeper in black soldier fly business.